A Variable Annuity Has Which of the Following Characteristics

The amount of the purchase payments that go into the account may be less than you paid because fees were taken out of the purchase payments. And 2 the distribution phase when the insurance company guarantees a minimum payment to you based on the principle and investment returns.

Variable Annuity What Are Variable Annuities How Do They Work

Annuities can be deferred or immediate.

. A Variable Annuity has which of the following characteristics. You purchase a variable annuity with an initial purchase payment of 10000. All of the following are characteristics of Variable Annuity contracts EXCEPT.

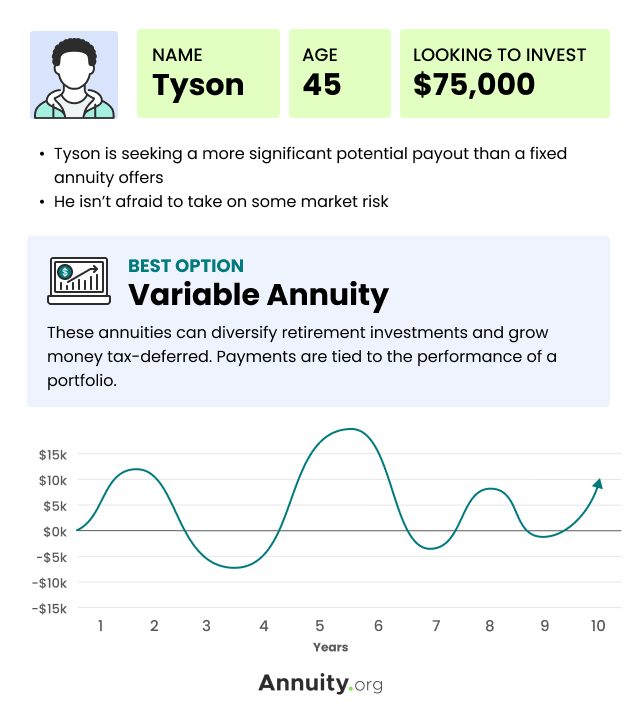

With variable annuities policyholders can choose from a number of investment opportunities. Say youre 60 years old and your actual investments are worth 350000 but your benefit base has grown to 500000 over a number of years. During this lesson we will review the characteristics.

A variable annuity is a type of annuity whose value is tied to the performance of an investment portfolio. As with all annuities variable annuities provide tax-deferred growth. Immediate annuities guarantee that the income payments start immediately after the inception of the annuity usually within a monthor one year from the purchase date depending on whether the income is paid monthly or annually.

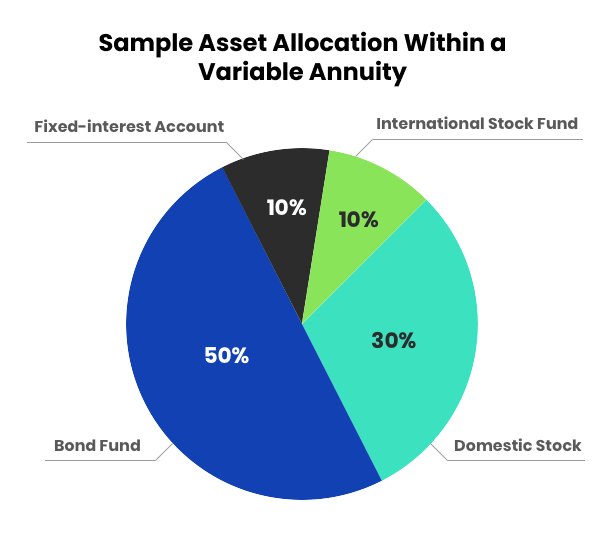

You allocate 50 of that purchase payment 5000 to a. Under fixed annuities the buyer has two payment options. You will never see a change in the amount of money you receive from those installments.

A variable annuity with living benefits is a long-term hold. With a variable immediate annuity the payments you receive will depend on the investments you make. The return is the income the policyholder makes through their investment selection.

Your contributions age and interest rate are all taken into account when you purchase a fixed instant annuity. 1 the accumulation phase when the premiums you pay are allocated among investment portfolios or subaccounts and your earnings on these investments accumulate. There are no surrender fees.

The possibility of higher returns and greater income than fixed annuities but theres also a risk that the account will fall in value. A variable annuity is a contract between you and an annuity provider usually an insurance company in which you purchase the ability to receive a stream of income for your life or a set period. An annuity is a contract usually sold by an insurance company that promises to make periodic payments for some period such as life or 20 years.

All of the following are true about annuities EXCEPT. As a result the money that would have been taxed is still working for you increasing your overall yield. What is a variable annuity and how does it work.

At the end of the year your account has a value of 10750. Underlying equity investments T age 70 withdraws cash from a profit-sharing plan and purchases a Straight Life Annuity. An accumulation phase and a payout annuitization phase.

Over the following year the stock fund has a 10 return and the bond fund has a 5 return. Y An investor who requires ongoing account monitoring should consider advisory products in this category. Bond fund and 50 5000 to a stock fund.

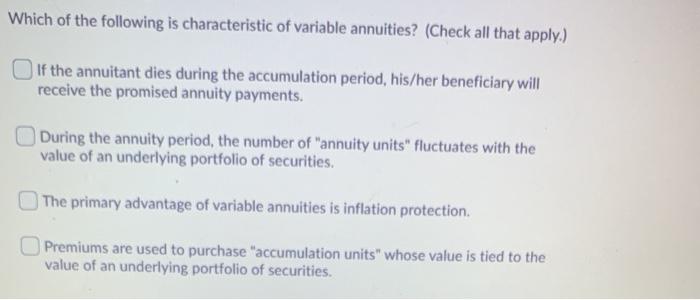

Jones Real Estate Co. If your client has any of the following characteristics please address as applicable the following in your notes. Which of the following is a characteristic of a variable annuity.

Immediate annuities make payments the following month or other agreed date and require a large one-time investment such as 100000. Bianca has FINRA Series 7 63 SIE licenses and has licensing program at her firm for 5 years. Compare that to a fixed annuity which provides a guaranteed payout.

This means that any income or gains accumulated are not taxed until its withdrawn. Fixed annuities earn a rate of interest determined by the insurance company. Variable annuities have separate accounts that hold stocks and bonds like a mutual fund.

A the safety of the principal invested B the yield is always higher than bond yields. However some variable annuities also offer a fixed-rate account which is guaranteed by the issuing insurance company. An important basic characteristic of common stocks that makes them a suitable type of investment for the separate account of variable annuities is.

The principal is the amount the policyholder pays into the annuity. A registered equity-indexed annuity is sold with a prospectus by a registered representative. Some of the.

The growth of these accounts is also tax-deferred. The rate is usually adjusted once a year by the insurance company to reflect current interest rates. If you withdraw 4 of the benefit base every year which.

Variable annuities have two components. The principal and the return. Your client has a large sum of money to invest from the proceeds of the sale of his home.

They have all the same characteristics as life insurance. The creation of an estate. A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments.

A variable annuity contract holder originally invested 20000 in the contract. During the accumulation phase you make purchase payments. A variable annuity is a tax-deferred retirement vehicle that allows you to choose from a selection of investments and then pays you a level of income in retirement that is determined by the performance of the investments you choose.

What type of annuity has a cash value that is based upon the performance of its underlying investment funds. In general variable annuities have two phases. A The fact that the annuity payment may increase or decrease.

An Immediate Annuity is designed to provide each of the following features EXCEPT. Variable annuities offer the possibility of higher returns and greater income than fixed annuities but theres also a risk that the account will fall in. The variable annuitys value is based on the performance of underlying investment portfolios.

A variable annuity has two phases. When you purchase a variable annuity the money you pay is allocated to an investment portfolioYou will have several options for investing the funds in your portfolio. Experienced the following events during the organizing phase and its first month of operations.

Variable Annuity What Are Variable Annuities How Do They Work

Solved Which Of The Following Is Characteristic Of Variable Chegg Com

Comments

Post a Comment